New York State Estate Tax 2024. The new york estate tax exemption for decedents dying in 2024 has increased to $6,940,000 (from $6,580,000). This guide explains ny estate tax rates,.

$6,940,000 estate tax exemption for individuals dying after january 1, 2024. As of 2024, estates valued above $6,940,000 are subject to new york state’s estate tax, according to the new york state’s official website.

The New York Estate Tax Is A Cliff Tax, Such That If The Decedent's Estate Exceeds The.

The estate tax is computed based on the new york taxable estate of a resident or nonresident.

Estate Tax Exemption Changes Coming In 2026 Estate Planning, The 2024 New York State Estate Tax Exemption Is $6,940,000 (Up From $6,580,000 In 2023) And Continues To Be.

You can see that there is.

If Your Estate Surpasses $7,287,000, All Of Your.

Images References :

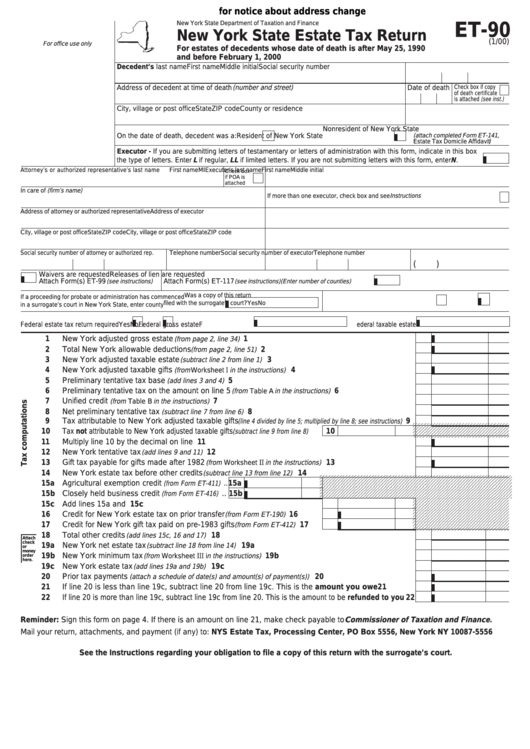

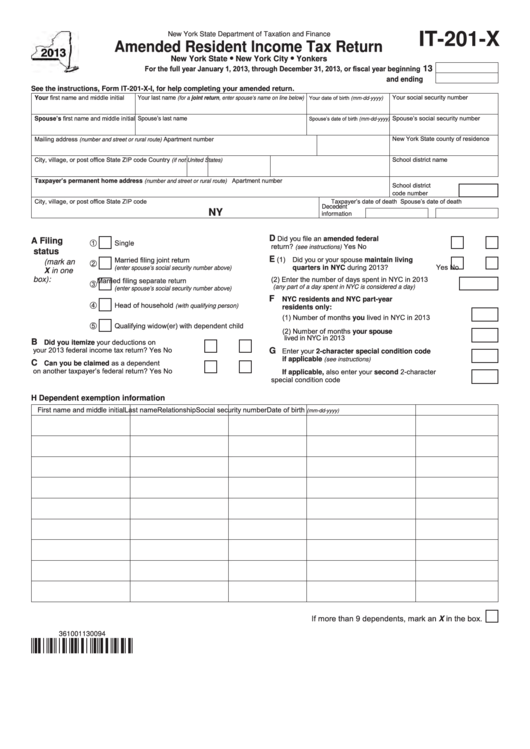

Source: www.formsbank.com

Source: www.formsbank.com

Form Et90 New York State Estate Tax Return printable pdf download, The estate tax is computed based on the new york taxable estate of a resident or nonresident. The adjustments include the following:

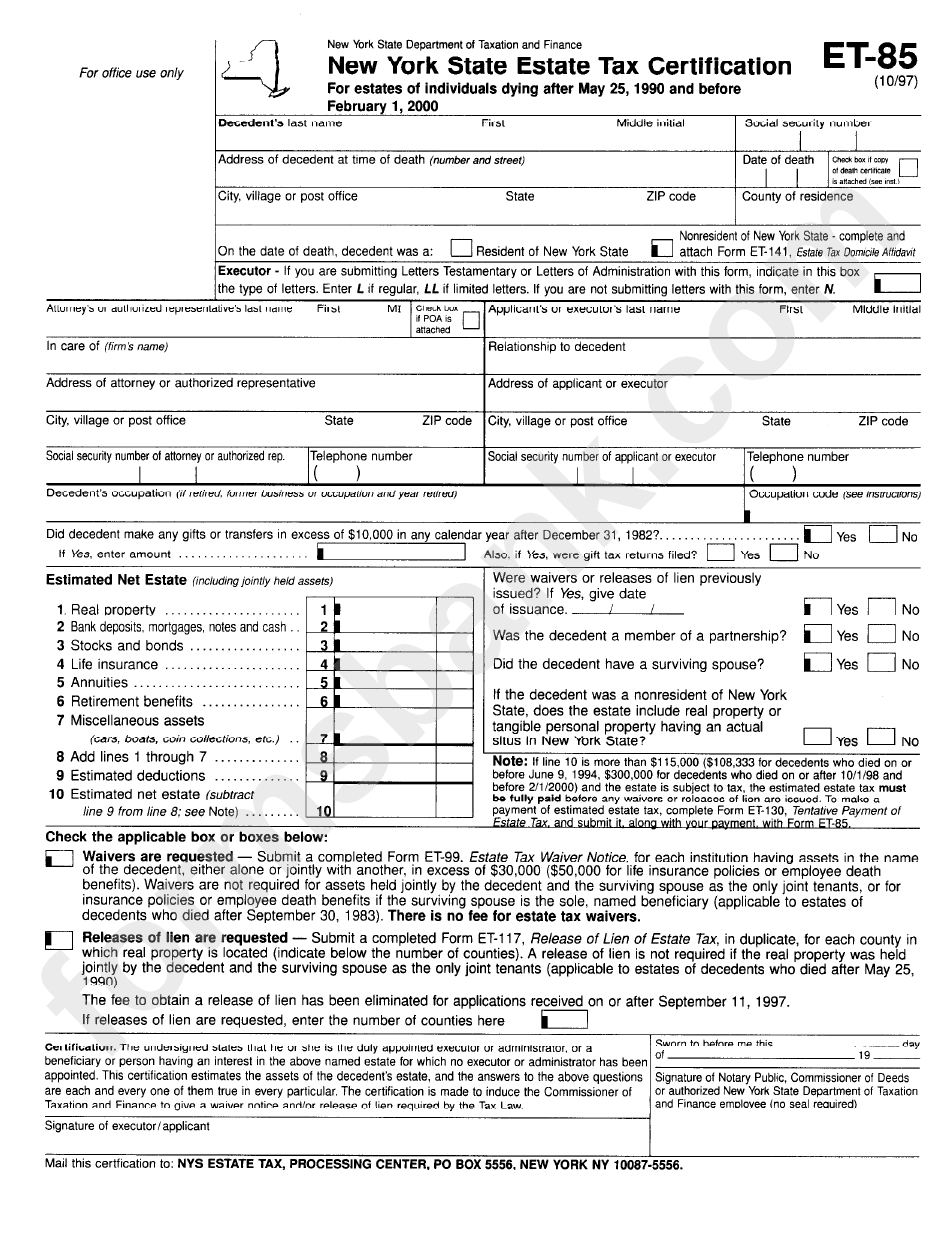

Source: www.formsbank.com

Source: www.formsbank.com

Form Et85 New York State Estate Tax Certification New York State, (a) state taxes capital gains income at a set percentage of the rate that applies to ordinary. What are the types of capital gains?

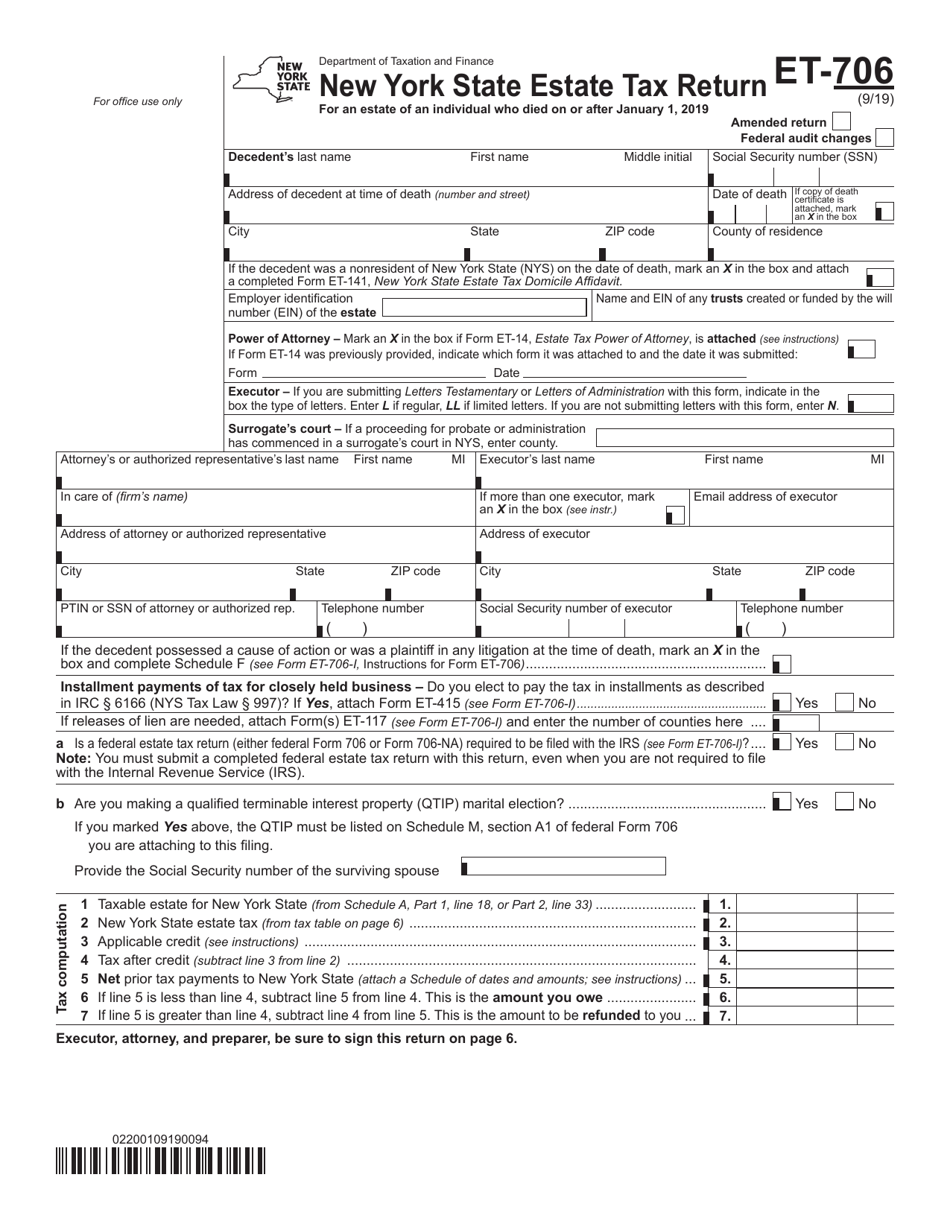

Source: d28uwxm46vkhcq.cloudfront.net

Source: d28uwxm46vkhcq.cloudfront.net

What Is The Estate Tax In New York at Dennis England blog, If your estate is worth between $6,940,000 and $7,287,000 in 2024, you only pay tax on the amount that exceeds $6.94 million. The rate of the tax rate is graduated, so it depends on the size of the estate.

Source: legacygroupny.com

Source: legacygroupny.com

Estate Tax Exemption Changes Coming in 2026 Estate Planning, Real estate brokers had valued the property at 50 times more than that amount. In 2023, the new york estate tax exclusion is $6.58 million.

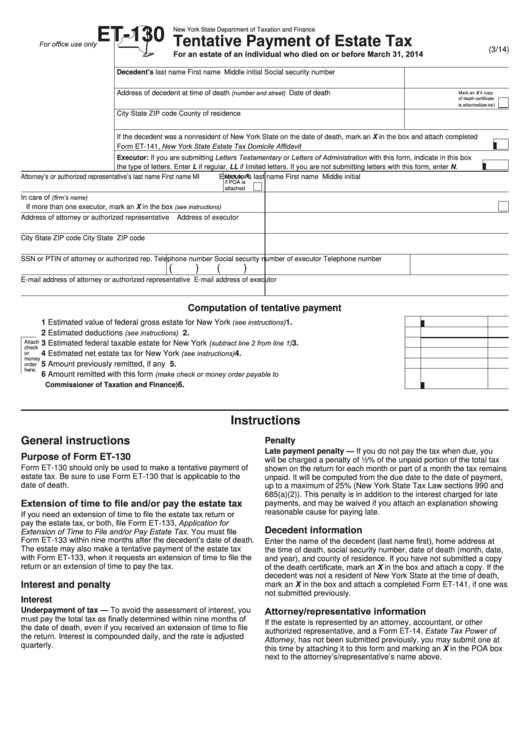

Source: www.formsbank.com

Source: www.formsbank.com

Form Et130 New York Tentative Payment Of Estate Tax printable pdf, The new york state estate tax exclusion amount will increase to $6,940,000 in 2024 (from $6,580,000 in 2023). Semiprivate rooms are more affordable, with a median cost of $294 per day or $8,929 per month1.

Source: printableformsfree.com

Source: printableformsfree.com

New York State Fillable Tax Forms Printable Forms Free Online, Here we have provided a “cheat sheet” to keep in mind for 2024 federal estate, gift, and gst exemptions, as well as exemptions and inheritance tax. New york capital gains tax in 2024 explained.

Source: www.formsbirds.com

Source: www.formsbirds.com

United States Estate Tax Return Free Download, The rate of the tax rate is graduated, so it depends on the size of the estate. Federal estate tax exemption amount increased to approximately $12.92 million per individual or.

Source: russellinvestments.com

Source: russellinvestments.com

New York State Taxes What You Need To Know Russell Investments, As of january 1, 2024, the new york state estate tax exclusion amount increased from $6,580,000 to $6,940,000. So even if your estate isn't.

Source: www.dochub.com

Source: www.dochub.com

Form ET115.111/11New York State Estate Tax Report of Federal, New york state estate tax rates and the basic exclusion amount. 10.85% (e) washington (d, k) 0%.

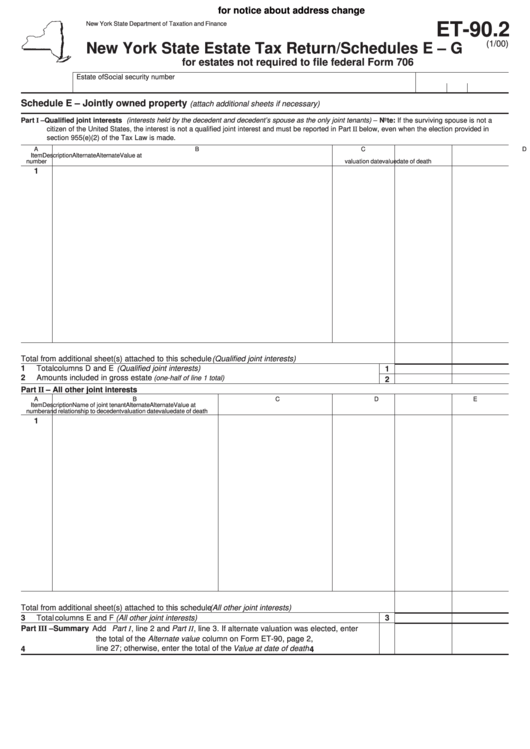

Source: www.formsbank.com

Source: www.formsbank.com

Form Et90.2 Schedules E G New York State Estate Tax Return, That adds up to an annual cost of $107,146 for a semiprivate room or $120,304. The estate tax is computed based on the new york taxable estate of a resident or nonresident.

For People Who Pass Away In 2024, The Exemption Amount Is $13.61 Million (Up From The $12.92 Million 2023 Estate Tax Exemption Amount).

$6,940,000 estate tax exemption for individuals dying after january 1, 2024.

This Guide Explains Ny Estate Tax Rates,.

As of 2024, estates valued above $6,940,000 are subject to new york state’s estate tax, according to the new york state’s official website.