Medicare Tax Rate 2024 High Income Based. The average part d premium is around $55.50, though. The income brackets are the same.

How can one lower their income to avoid potential irmaa charges? This is the amount you’ll see come out of your paycheck, and it’s matched with.

Medicare Tax Rate 2024 High Income Based Images References :

Source: adrianawmabel.pages.dev

Source: adrianawmabel.pages.dev

2024 Medicare Tax Rates And Limits Flori Jillane, The standard part b premium is $174.70 in 2024.

Source: jeanneymandie.pages.dev

Source: jeanneymandie.pages.dev

Medicare Limits 2024 Chart Pdf Licha Othilie, The annual deductible for all medicare part b beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible.

Source: adrianawmabel.pages.dev

Source: adrianawmabel.pages.dev

2024 Medicare Tax Rates And Limits Flori Jillane, That threshold is between $125,000 and $250,000 depending on your.

Source: corrybmarrilee.pages.dev

Source: corrybmarrilee.pages.dev

Medicare Limits 2024 Chart Zena Sarette, The medicare tax rate for employers in 2024 is set at 1.45% on all employee earnings, with no cap on the maximum income subject to medicare tax.

Source: traceewdahlia.pages.dev

Source: traceewdahlia.pages.dev

Medicare Premiums For High Earners 2024 Terra, Like social security tax, medicare tax is withheld from an.

Source: viviaychrystal.pages.dev

Source: viviaychrystal.pages.dev

2024 Tax Rates And Deductions Available Tessi Gerianne, Income up to ₹3 lakh:

Source: kizzeewshane.pages.dev

Source: kizzeewshane.pages.dev

Medicare Premiums 2024 Based On Ashli Camilla, In 2024, only the first $168,600 of your earnings are subject to the social security tax.

Source: janetyconstanta.pages.dev

Source: janetyconstanta.pages.dev

Medicare Irmaa Limits 2024 Allx Nikoletta, The affordable care act enforces high wage earners to pay an extra medicare payroll tax, or medicare surtax, of 0.9% on earned income.

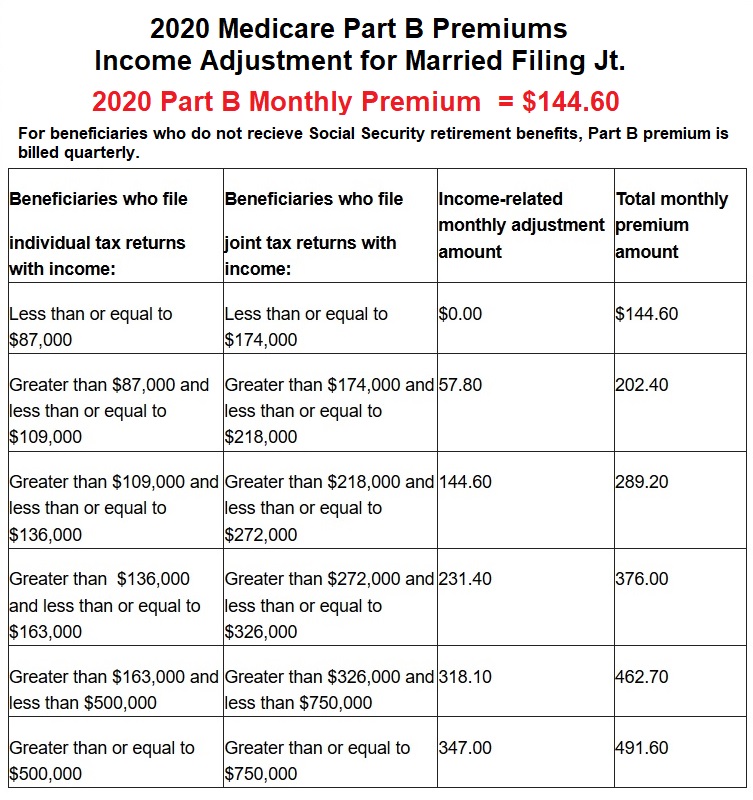

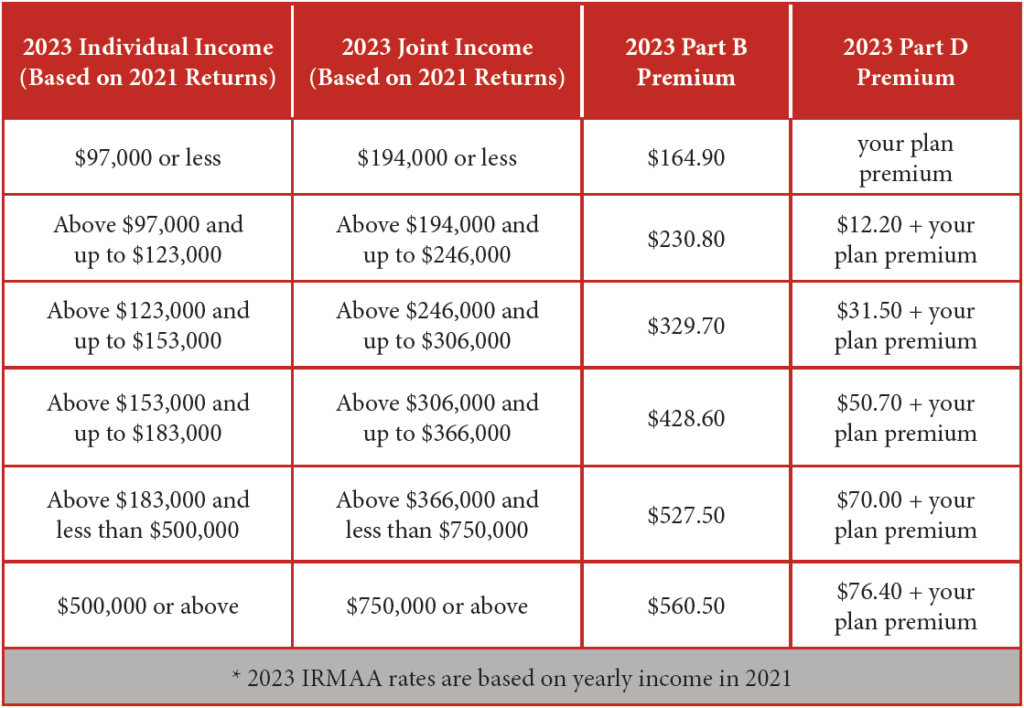

Fica And Medicare Rates 2024 Riva Verine, Medicare uses your tax return from 2 years ago.

Source: gabiyellissa.pages.dev

Source: gabiyellissa.pages.dev

Employer Fica And Medicare Rates 2024 Chart Nelle Yalonda, Like social security tax, medicare tax is withheld from an.

2024